2 minute read

Subcontract sector up overall but uncertainty remains

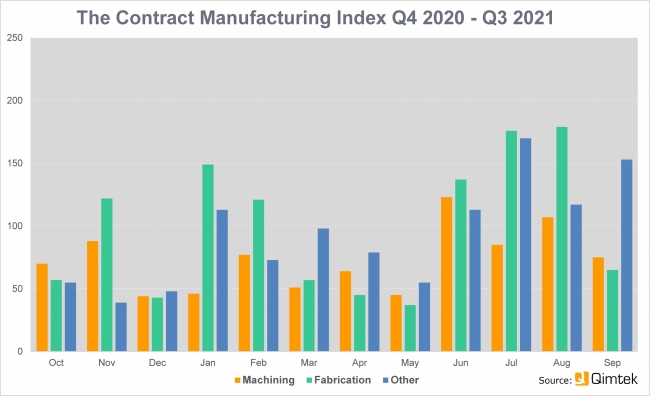

The latest Contract Manufacturing Index shows that the subcontracting market grew strongly in July and August but fell back in September amid concerns over material, staff and transport shortages.

This meant that more suppliers were unwilling to quote without knowing what their costs would be, while more buyers were hesitant about placing orders due to uncertainty over demand and pricing.

The Index for the third quarter of 2021 stood at 117, a 52% increase on the previous quarter and just slightly (5%) down on the equivalent quarter in 2020, when the market bounced back after the first Covid-19 lockdown. The strong growth in July and August followed by a falling back in September mirrored the results seen last year. The CMI of 78 for September was comparable with the overall CMI of 77 for the second quarter of this year.

Growth in the subcontract manufacturing sector in Q3 2021 was 52% higher than Q2 but a poor September highlights uncertainty over material, staff and transport shortages / Picture: Getty/iStock

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3.4bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

The baseline for the index is 100, which represents the average size of the subcontract manufacturing market between 2014 and 2018.

The strongest sector in the third quarter was industrial machinery, which was up by more than 150% on the previous quarter. Construction and construction equipment also saw strong growth as did consumer products and the food and beverage sector. Conversely, demand dropped significantly in the electronics, furniture and agricultural sectors. In terms of process, fabrication accounted for 53% of the market (47% in Q2), while machining dropped to 36% of the market (44% in Q2). Other processes, including moulding and contract electronic manufacturing, accounted for the remaining 11%.

Qimtek owner Karl Wigart, said: “Once again we are seeing the underpinnings of a sound recovery in the market being held back by uncertainty caused by supply chain issues.

“July and August were busy with good levels of activity from buyers and suppliers. In September, the mood changed. More projects went unquoted by suppliers and more buyers were holding back on projects. Suppliers are telling us that it is difficult to commit on prices with material, staff and transport shortages. Buyers are hesitant as they are not sure of demand and pricing. It is a Catch 22 situation.”

Graphic & data courtesy of Qimtek