2 min read - 23 Jul, 2025

Full steam ahead for subcontract manufacturing market in Q2

The subcontract manufacturing market leapt ahead in the second quarter of 2025 as large buyers returned to the market with new projects. The signs are that there is more to come, with the quarter ending at its highest level since January 2023.

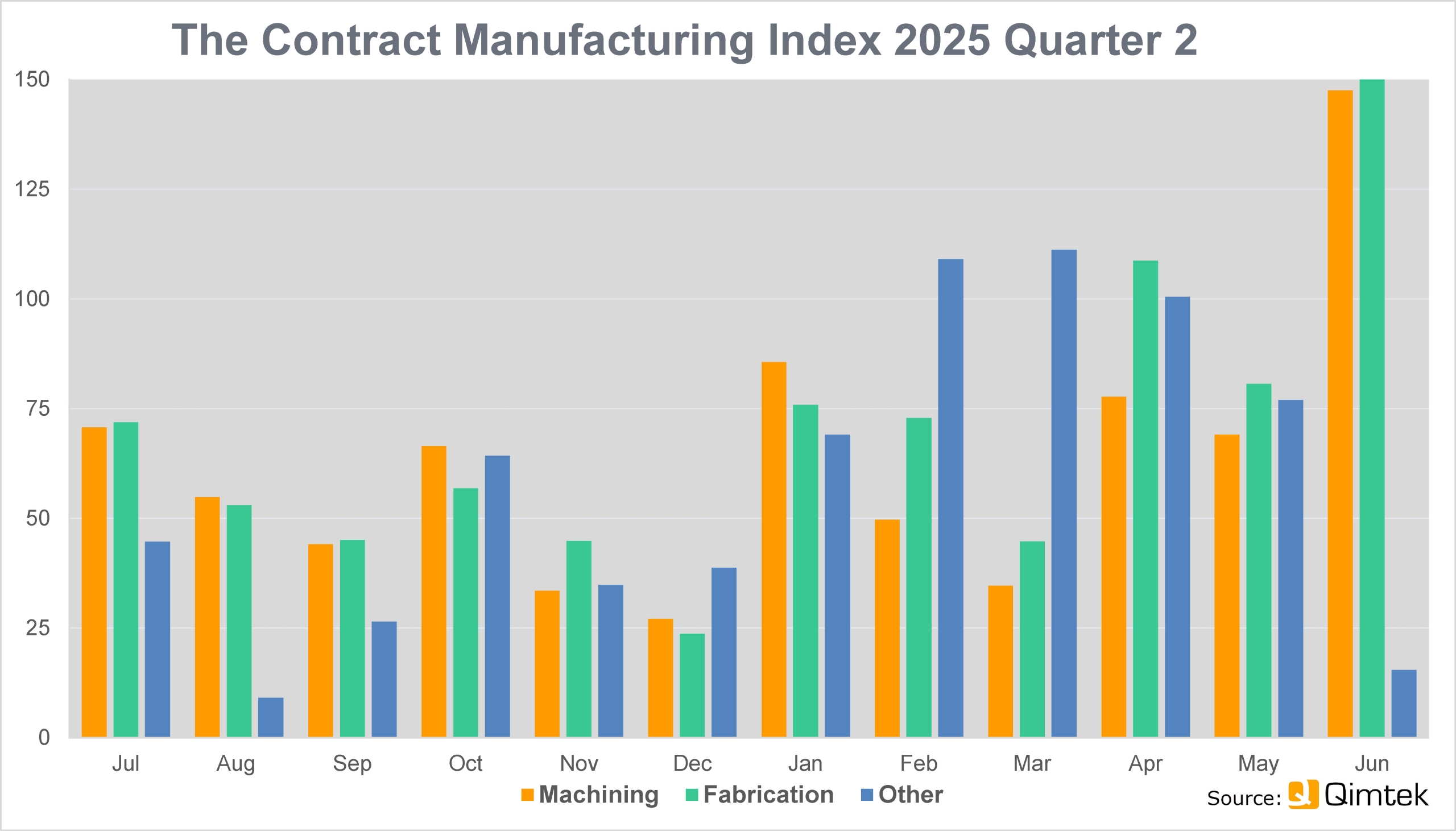

The latest Contract Manufacturing Index (CMI) shows that the subcontract market was up 61% on the previous quarter, which was itself 50% up on the final quarter of 2024.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies that could be placing business, collectively having a purchasing budget of more than £3.4bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

The baseline for the index is 100, which represents the average size of the subcontract manufacturing market between 2014 and 2018.

The CMI for the second quarter of 2025 was 103, compared with 64 for the first three months of the year. The market was also significantly up on the same quarter last year, when the CMI stood at 59.

The subcontract manufacturing market leapt ahead in Q2 2025, with the quarter ending at its highest level since January 2023 / Picture: Getty/iStock

Over the course of the second quarter, the market surged in April, with the index more than doubling over the previous month. May was not quite so strong, but still healthy and positive. The market then leapt ahead in June, with the index almost doubling again to end the quarter at the highest level since January 2023.

Within the overall figure, machining accounted for 45% of the market, fabrication was up 4% at 50% of the market, and other processes, including moulding and electronic assembly, dropped to 5% of the market.

There was considerable change in the split by end market compared to the previous sector.

Automotive leapt into pole position as the largest market – an astonishing 90,000% jump from what had been a very low Q1. It was worth almost twice as much as the second largest market, marine.

In a surprise upset, the third place was industrial machinery, which had been the top market since the third quarter of 2021 and dropped in value by 30% compared to the previous quarter. The fourth and fifth largest markets were consumer products and heavy vehicles/construction equipment.

Qimtek owner Karl Wigart, said: “It is good to see the market up on the previous quarter. It finally seems to be getting up some momentum and shrugging off potential adverse factors. That said it is an uneven market. We have not had lots of new projects, but we have seen some of the larger buyers coming back to the table. We are hearing that there are more projects to come, but buyers are not sure when that will be. Hopefully this growth will continue in the next quarter.”