4 min read - 11 Sep, 2025

UK automotive sector generates £115bn five years on from Brexit

Five years on from Brexit, SMMT’s latest trade report, Unmarked Routes: Britain’s Pathway To Stronger Automotive Trade, sets out how the UK sector remains a global trading powerhouse, generating £115bn in imports and exports last year. The sector is on course to generate more than £110bn in trade for the third year running, shipping vehicles, parts and components around the world, in the face of incredibly tough conditions with tariff barriers, rising protectionism, and geopolitical uncertainty.

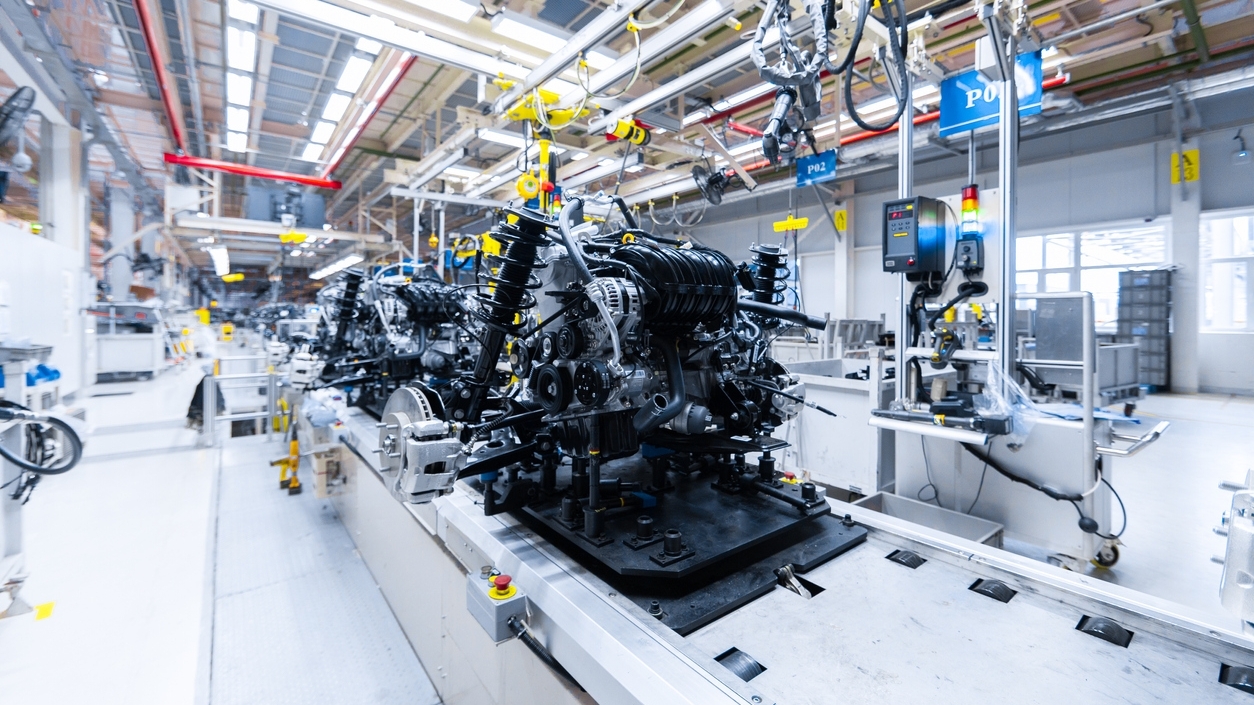

While Brexit can be viewed as one challenge among many, leaving the EU has fundamentally altered trade conditions between the UK, the EU and other major trading partners. The industry has had to absorb significant costs from new customs and border requirements, while facing additional regulatory and tariff barriers and trying to secure billions to invest in electrification and other new technologies.

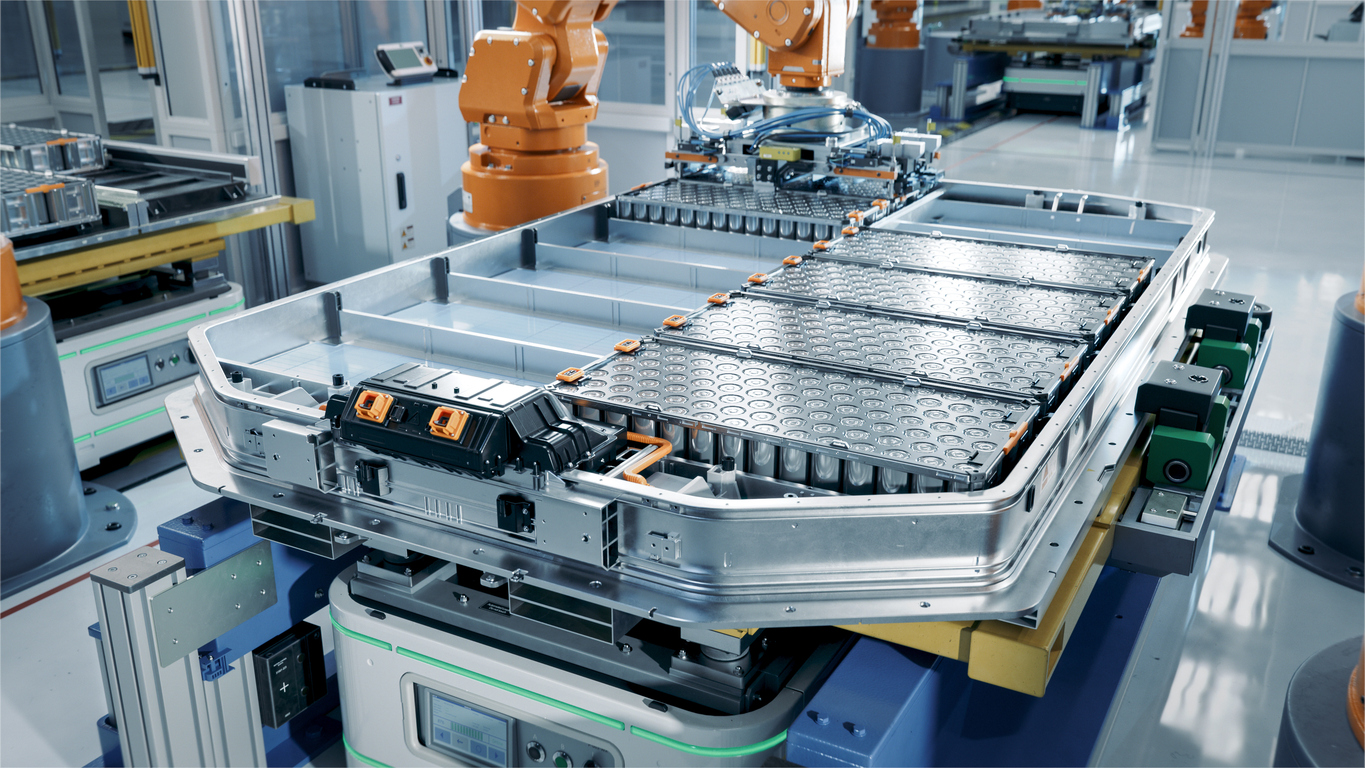

Despite the EU-UK Trade and Cooperation Agreement (TCA) being signed almost five years ago, uncertainty still remains, with a lack of clarity on trade definitions for key battery components, and tougher rules of origin for electric vehicles due to kick in in less than 16 months.

A new SMMT trade report sets out UK automotive’s £115bn global trading hub status despite the most challenging environment in decades.

While many factors have affected global trade performance since Brexit, bilateral UK-EU automotive trade has underperformed compared with the UK’s trade with the rest of the world. This has been most visible in a slowdown in both export and import values with the bloc. Given the export focus of the sector, growing trade with all export markets is important, but with more than half of UK car exports heading into the EU and the vast majority of cars bought in Britain coming from Europe, the importance of cross-Channel trade is stark.

The UK and EU sectors remain inextricably linked, despite Brexit delivering a seismic change in trading conditions. Annual automotive trade of £68.4bn was generated between the two markets last year, representing by far the bulk (59.7%) of all UK automotive trade value. A closer relationship would help safeguard this critical business – business that is increasingly driven by electrified vehicles (EVs) – with battery electric, plug-in hybrid and hybrid models now the largest proportion of cross-border automotive trade.

As a result of significant investments by manufacturers based in the UK and EU to deliver ever greater EV model choice, alongside growing demand, trade in EVs across the Channel has continued to rise. The value of this trade is up 424% compared with pre-Covid levels, from £4.6bn in 2019 to almost £24bn in the 12 months to June 2025.

Hybrid and battery electric vehicles are now the main contributors to the sector’s trade balance, leading in terms of imports and exports between the UK and the rest of the world.

The value of UK battery electric, plug-in hybrid and hybrid electric vehicle exports to the EU has consistently outpaced pure internal combustion engine (ICE) shipments, and is today worth double. EU manufacturers, meanwhile, shipped EVs worth £17.6bn to the UK in the last 12 months up to June 2025, with pure electric shipments outpacing those from China more than two-fold, and overtaking the value of ICE exports for the first time.

This growth is at risk, however, from a lack of clarity around tougher rules of origin requirements – agreed as part of the UK-EU TCA – for batteries and battery parts due from January 2027. These rules are currently unclear regarding how cathode active materials (CAM), an essential component in battery production, are defined, and they also set thresholds for local production in the UK or EU that are extremely challenging. Despite massive investments into the battery supply chain – notably in Somerset and Sunderland in the UK and at various locations across Europe – supply has not kept pace with demand.

Unless localised battery production increases considerably in the next 16 months – an impractical expectation given investment and construction timescales – electrified cars, buses and commercial vehicles that do not meet these new thresholds will be subject to tariffs ranging between 10% and 22% when traded across the Channel. With combustion models facing 0% tariffs, such a situation would make electrified vehicles uncompetitive in each market at a time when regulations stipulate manufacturers sell ever more zero-emission models.

The sector is on course to generate more than £110bn in trade for the third year running, shipping vehicles, parts and components around the world.

Industry is therefore calling on government to monitor expected compliance rates with 2027 EV rules of origin and engage immediately with the EU to agree on a workable cathode active material definition. In parallel, the industry calls on government to consult with businesses and fast-track negotiations with the EU and other parties to re-join the Pan-Euro Mediterranean (PEM) Convention on rules of origin. While not a panacea, doing so would help strengthen UK-EU auto trade, enhance market access in trade with 14 other PEM participants and offer a flexible alternative to address this challenge if offered in parallel to TCA origin rules.

Mike Hawes, chief executive of SMMT, said: “Despite the most difficult environment in decades, UK automotive remains a powerhouse of global trade. With its unmatched diversity and world-class capability, the sector already trades across the world. But the global trading environment is getting tougher; more competition, more protectionism and more geopolitical tension. Forging closer trading relationships, notably with the EU, and implementing industrial and trade strategies with automotive at their heart will enable us to grow our economy, create thousands of highly skilled jobs, and lead the charge toward net zero.”