2 min read - 20 Oct, 2025

Subcontract manufacturing market continues to grow in Q3

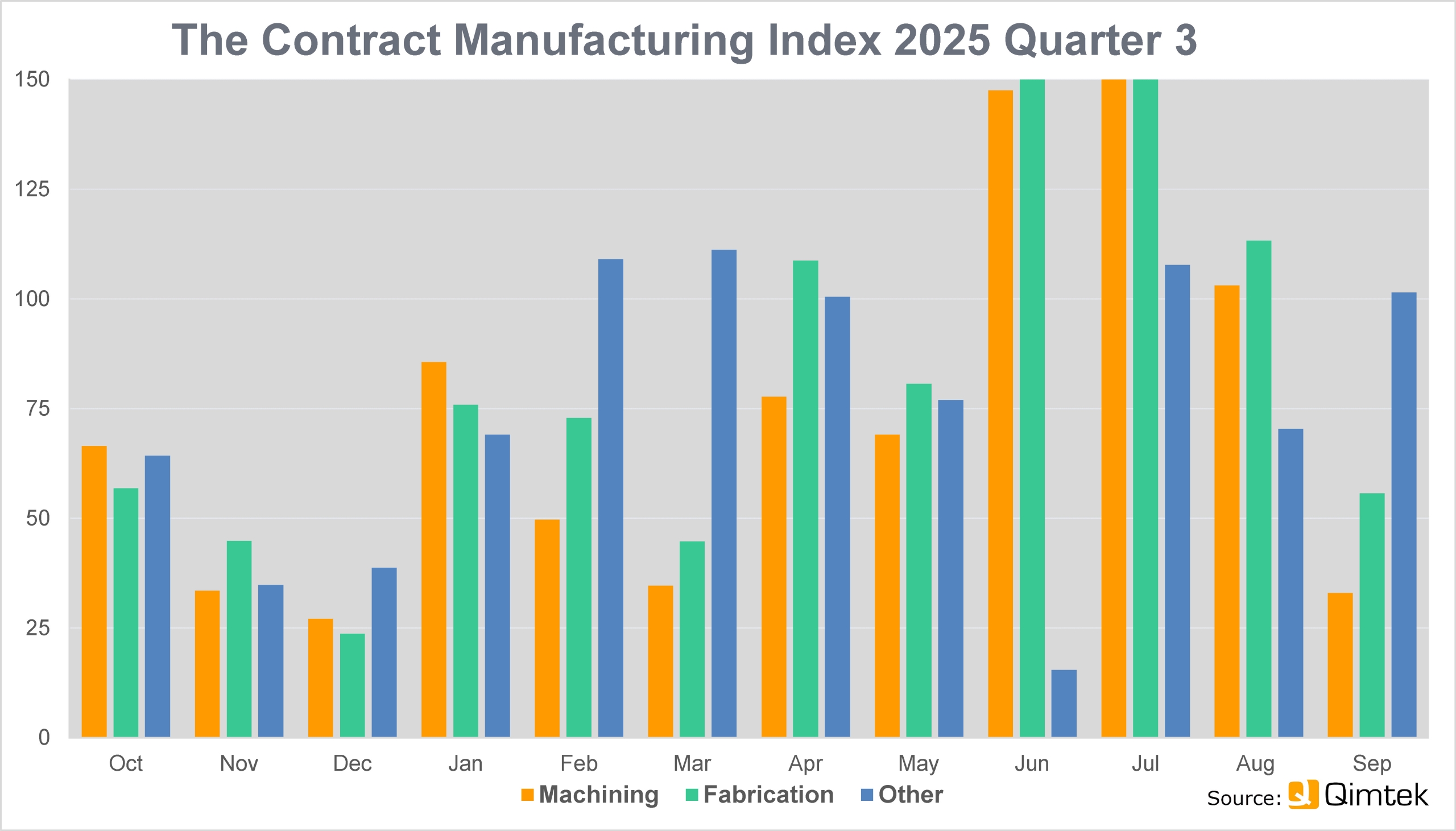

The subcontract manufacturing market continued to grow in the third quarter of 2025. It was up 10% on the previous quarter, which had already seen substantial growth from April onwards. However, following a strong start, the market slowed down in September.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies that could be placing business, who collectively have a purchasing budget of more than £3.4bn, a supplier base of over 7,000 companies, and a verified turnover in excess of £25bn.

The baseline for the index is 100, which represents the average size of the subcontract manufacturing market between 2014 and 2018. The CMI for the third quarter of 2025 was 113, compared with 103 for the second three months of the year.

On a month-by-month basis, July was impressively strong – by far the strongest month of the year so far and a third higher than June. Activity was lower in August, but still at a healthy level. In September, though, the market dropped significantly, possibly due to the direct and indirect effects of the JLR cyber-attack.

The subcontract manufacturing market continued to grow in the third quarter of 2025, rising 10% on the previous quarter.

The market in Q3 was also significantly up on the same quarter last year, when the CMI stood at just 53, having been knocked back by uncertainty following the Chancellor’s Autumn Budget.

Fabrication work accounted for 53% of activity and was up 18% on the previous quarter. Machining dropped from 45% of the market to 39% and by 2.5% overall. Other processes, including moulding and electronic assembly, accounted for 7% of the market and were up by 44%.

Looking at the market sector by sector, automotive was again the largest market, but dropped sharply from the end of July. The second largest sector was heavy vehicles/construction equipment, and industrial machinery remained the third largest sector.

The Contract Manufacturing Index shows the value of the market for contract and subcontract manufacturing services for machining, fabrication, and other processes.

Karl Wigart, Qimtek owner, said: “At the end of the second quarter, we started to see larger buyers coming back with new projects, with the hope of more to come. That was certainly the case in July and August. However, September was very slow. There was good activity both from buyers and suppliers in the first two months, but in the last it slowed down drastically from both.

“What is a bit surprising is that quoting activity has dropped as well as lead times. When the manufacturing sector is slow, you would expect highly competitive quoting for custom-made parts, but that is not the case. Are suppliers of custom-made parts being cautious and holding back on growth as it is difficult and expensive to employ more staff? And perhaps they are worried about what this year’s Budget might bring?”