2 min read • published in partnership with Moore Kingston Smith

European manufacturing and distribution sector deals up, new report shows

Moore Kingston Smith has released its latest manufacturing investment report, analysing M&A and fundraising transactions from January to June 2025.

Key findings from the report, which examines data from PitchBook, show that M&A (mergers and acquisitions) and fundraising activity in the European manufacturing and distribution sector presented a mixed picture in the first half of 2025. Overall deal volumes were up, recording 2,704 transactions across the whole of Europe, however, results varied considerably by region.

Despite experiencing a 6% decline in the number of deals completing, the UK remains Europe’s busiest country for M&A and fundraising activity. While the number of completed UK transactions (501) and overseas-backed deals (160) declined from H2 2024, foreign investment in the manufacturing and distribution sector surged to £16.5bn, the highest since the pandemic.

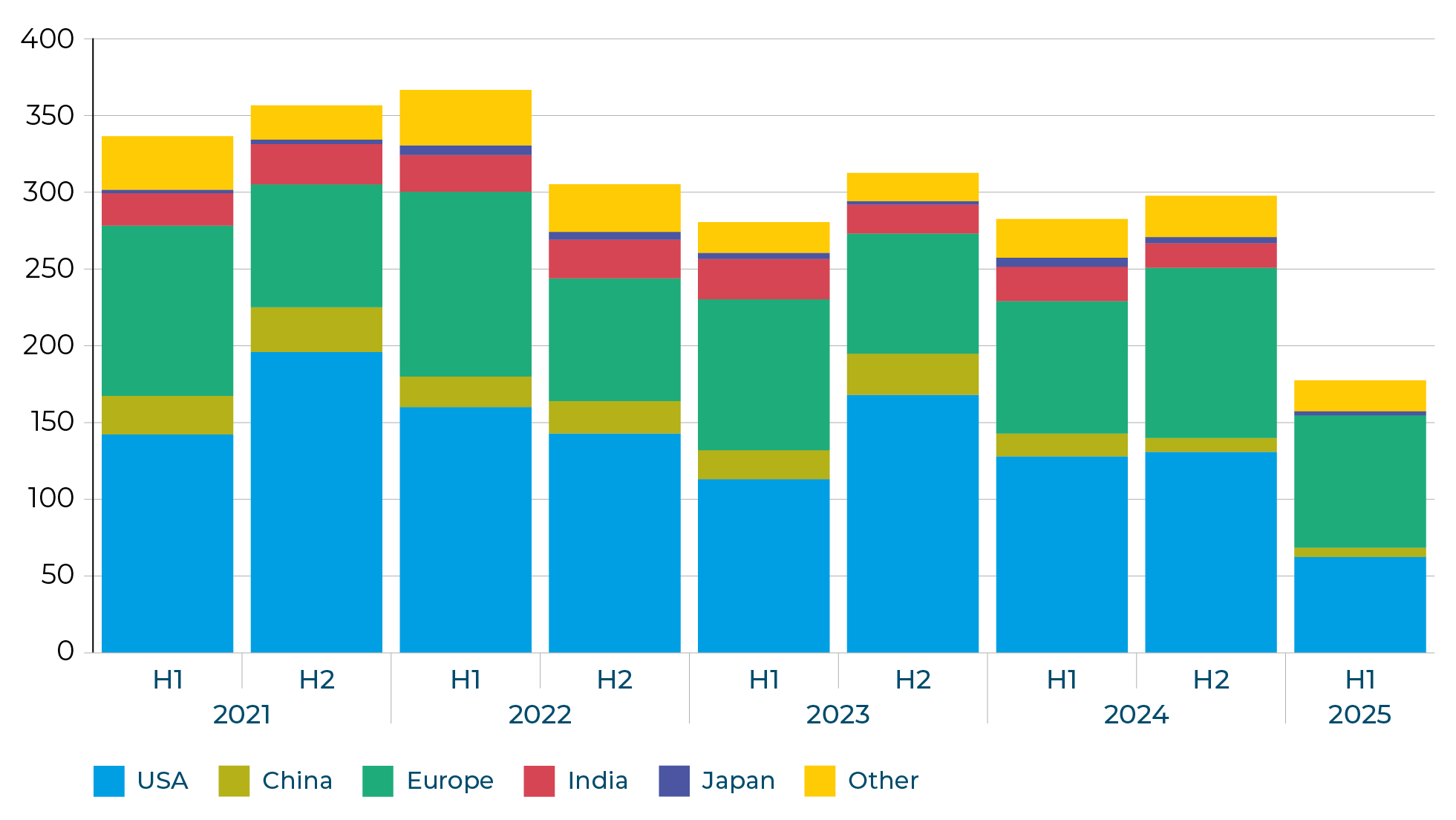

The number of UK deals involving US investment has seen a dramatic decline. For the first time, more UK transactions involving European acquirers and investors were counted, compared to US ones (graphic below).

By sector, the aerospace and defence industry posted a 60% increase in the number of deals completing in H1 2025, anticipated mainly as a response to geopolitical events.

Foreign investment deal count for transactions involving a UK target / Graphic: Moore Kingston Smith

Looking ahead

Moore Kingston Smith’s outlook for the European manufacturing and distribution sector for the remainder of 2025 is cautiously optimistic, with growth in the number of M&A and fundraising transactions expected despite ongoing challenges. Fears that US tariff policies will lead to higher goods prices and a global economic slowdown do not make for a benign investment environment. However, it is the US that investors judge will be worst affected by such policies. In the face of perceived US economic instability, they are increasingly turning their attention to Europe.

In the UK, falling interest rates are expected to help manufacturing and distribution businesses improve their profitability and enhance the ability of private equity to complete leveraged transactions.

At the end of June, the UK government published its new industrial strategy. It identified eight sectors that it believes have the highest potential for economic growth, including advanced manufacturing, life sciences, clean energy and defence. The centrepiece of the industrial strategy is reducing energy costs for big electricity users. Additionally, the government plans to invest in speeding up grid connections to enable new manufacturing facilities to be built and to speed economic growth.

Picture: Getty/iStock

Other measures include increasing finance for the British Business Bank, which will be allowed to take equity stakes in SMEs. While the proof will be in the pudding, the published strategy received a generally warm reception from British business, with the CBI describing it as “credible” and focused “on the areas of the economy where the UK can genuinely compete and win global market share”.

Jeremy Read, head of manufacturing, Moore Kingston Smith, commented: “The European manufacturing and distribution sector is navigating a complex landscape, facing both challenges and opportunities. By focusing on resilience, innovation and sustainability, businesses in this sector can position themselves for growth in the coming years and will be attractive to potential acquirers and investors.”

Full findings from the report can be found here.