4 minute read • published in partnership with Purbeck Insurance Services

Insight: Financing the factory floor – how UK manufacturers are managing personal guarantee risk

Things are looking up for UK SME manufacturers following fresh Government initiatives to break down procurement barriers, increase contract volumes and revenue opportunities. With an emphasis on innovation and technology niche SME manufacturers may have more room to grow if they have the right funding. Here, Todd Davison from Purbeck Insurance Services, examines what recent data reveals about borrowing trends in the sector — and how Personal Guarantee Insurance is being used to support funding decisions without amplifying personal risk.

2026 has kicked off with a number of initiatives to support SME manufacturers, one of which is a £20mn fund to support military tech start-ups. £11 billion in lending has also been unlocked by UK banks to help SMEs take advantage of trade deals. While it seems that Government and industry bodies are actively trying to better understand SME pain points, one of the fundamental challenges for many smaller manufacturers is not just access to finance it’s also the personal risk now attached to securing it.

Typically, SME manufacturers looking for a loan will need to navigate a cautious lending market, strict credit criteria and high interest rates (albeit rates have been falling due to the cut in the base rate). They will also almost certainly be asked for a personal guarantee from the owner/s or director/s of the business as security for the loan.

When finance comes with personal exposure

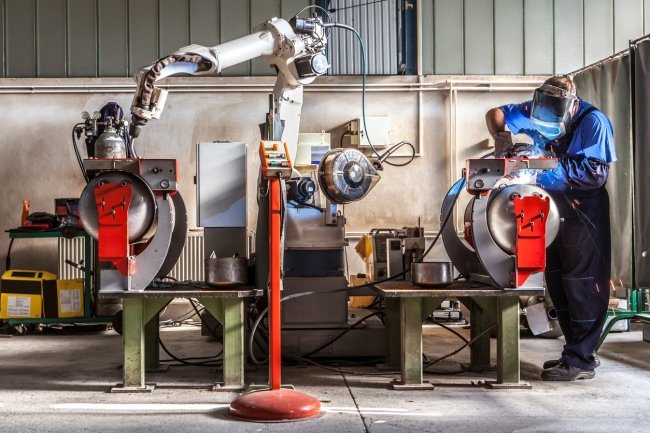

Manufacturing businesses often need significant capital – whether for machinery, tooling, technology, automation or stock. This means loans tend to be large relative to the business size and can extend over a long period. And a personal guarantee is often required in excess of £160,000 based on our loan data for the manufacturing sector. As long as the personal guarantee is fair and proportionate to the loan, asking for security for a loan is accepted lending practice and means from the borrower’s perspective, they have ‘skin in the game’.

For business owners though this request can force them to walk away from crucial funding. Personal guarantees can put homes, savings and family finances at risk, discouraging precisely the sort of investment the sector needs to improve productivity and competitiveness.

Updated guidance from The Insolvency Service

Recognising that personal guarantees have become a feature of small business lending, the UK Government updated its guidance on PGs at the start of the year. The advisory, published by The Insolvency Service, outlines the risks associated with signing a personal guarantee (PG) and explicitly highlights the availability of personal guarantee insurance to help safeguard directors’ personal assets if a guarantee is called in.

Our figures on the personal guarantee insurance we provide to manufacturing industry help illustrate how manufacturers are responding to the current environment.

A cautious year, with a late lift

Across the whole of 2025, applications for personal guarantee insurance from SME manufacturers remained steady compared with 2024. However when we drill down to quarterly trends, in the final quarter of the 2025, applications rose 10% on Q4 2024. That late uptick suggests that some SME manufacturers faced increasing working capital pressures or needed fresh funding as plans for 2026 began to take shape. Manufacturers appear to be borrowing where necessary, but with a clear eye on risk.

The reasons for loans

Looking at the reasons SME manufacturers are borrowing, from our data almost half (45%) of PG-backed loans in Q4 2025 were taken out to support working capital. This is not overly surprising given the rise in energy costs, employment costs, raw materials and so on, making the management of day-to-day cashflow more demanding.

Stock purchases accounted for a further 11% of loans, highlighting the ongoing need to hold inventory in an uncertain supply chain environment. Meanwhile, more positively, 18% of borrowing was for investment in growth initiatives, including expansion, productivity improvements and strategic projects.

This all suggests that growth has not dropped off the agenda altogether it has simply become more measured.

Size of personal guarantees shrinks

We have also observed that the typical size of a personal guarantee being insured has fallen. In Q4 2025, the typical level of personal guarantee cover stood at £161,386 — the lowest seen in the past two years. This could be down to basic caution over borrowing levels or directors trying to limit their personal exposure. Or of course, a combination of both. Even so, the risk remains significant, particularly as 55% of these loans were unsecured.

As such, Personal Guarantee Insurance is increasingly being treated as a standard risk management tool which is helping directors to proceed with essential borrowing while protecting their personal assets if things go wrong.

Managing risk without stalling progress

As Make UK has stated, long-term competitiveness depends on sustained investment in people, plant and productivity. Yet that investment often comes with big personal downside for business owners. The good news is that the rise in PGI applications in Q4 2025 suggests firms are being pragmatic by taking steps to protect themselves personally while enabling their businesses to operate, adapt and, where possible, grow.

For many, that balance is likely to define funding decisions in the year ahead. Regardless, managing the personal guarantee risk must remain a central part of the manufacturing finance conversation.

For more information on how Purbeck supports SME manufacturers, visit: Purbeck Insurance Services