7 minute read • published in partnership with Moore Kingston Smith

Moore Kingston Smith manufacturing report – maximising value ahead of a sale

Manufacturing outlook – August 2024

Manufacturing is a crucial part of the British economy, with the sector accounting for 9.3% of total UK economic output (gross value added) and 8.1% of employment at the end of 2023, according to the government.

Like many parts of the economy, it has had a challenging few years to navigate.

• The latest Make UK report, shows a significant decline in output growth in the first quarter of 2024, with the balance dropping to 5% from 20%.

• Although manufacturers have been able to pass price rises onto customers throughout the last 18 months, margins have been declining in 2024, indicating that rising costs are outpacing pricing adjustments.

Some recent data suggests a more positive outlook for the coming year.

• In May 2024, The Purchasing Managers’ Index (PMI) grew at its fastest level since April 2022, reaching 51.3.

ONS data points to the highest level of business confidence among manufacturers since February 2022.

• Improving sentiment underlines the sector’s resilience amidst labour shortages and high energy costs atop myriad crises over the last few years, from the pandemic to Brexit, Ukraine, the Panama Canal drought and ongoing supply chain issues.

Jeremy Read, Head of Manufacturing at Moore Kingston Smith, said: “This confidence is welcome though not surprising; in our over 100 years of advising firms, we’ve come to understand the impressive agility and resilience of people building businesses in the UK. We are cautiously optimistic about deal activity in the next 12 months.”

Picture: Getty/iStock

UK manufacturing still leads Europe in deal volume

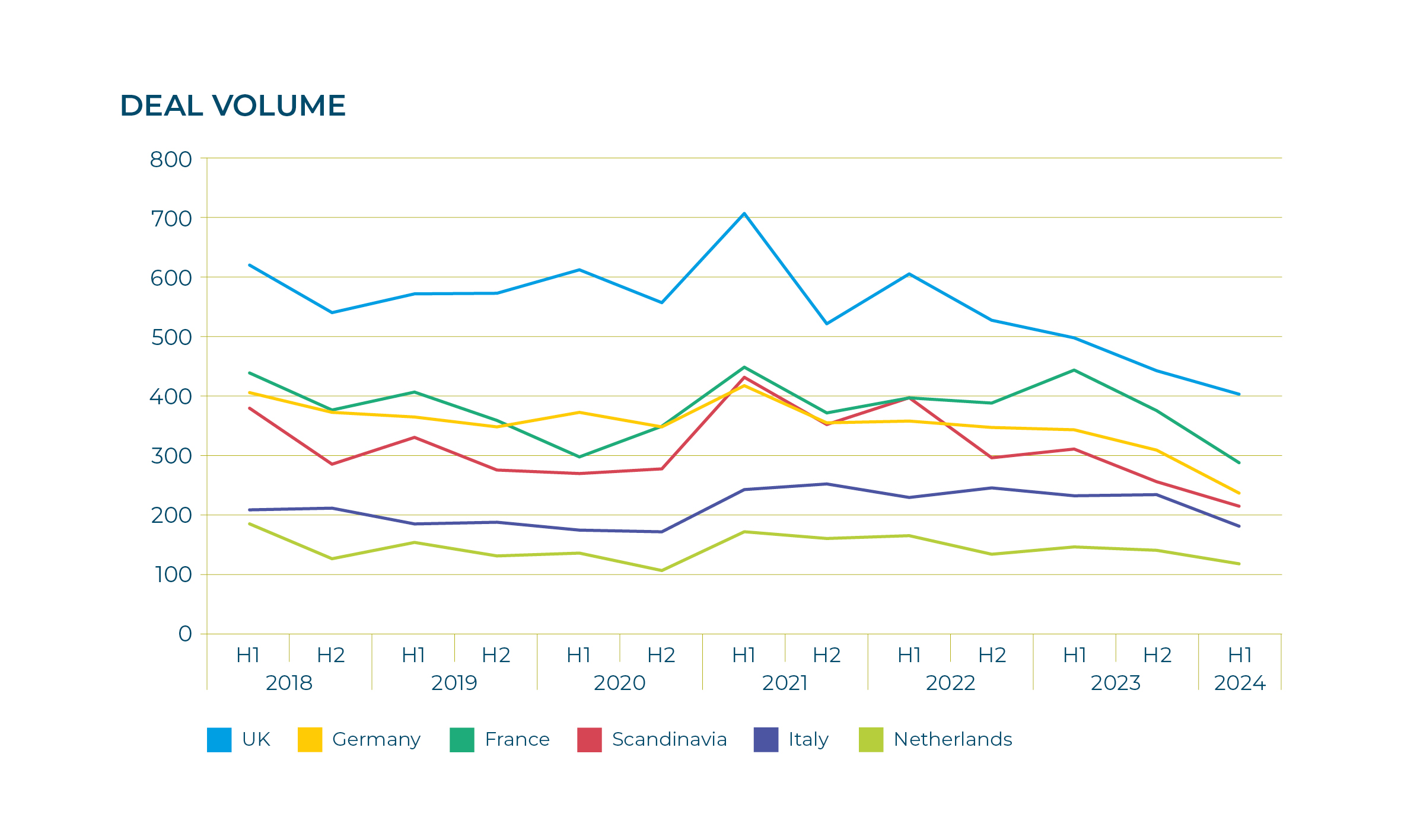

European deal volume for manufacturing has seen a steady decline since early 2021. The UK continues to attract the lion’s share of deal activity in Europe, with France’s traction gained in 2022 losing pace.

Manufacturing deal activity has declined from the highs of 2021, which is a common trend across many sectors as uncertainty took its toll and rising interest rates impacted the cost of capital.

We feel subdued deal activity may paradoxically reflect the relatively strong performance of the sector over the last 18 months. Manufacturers have generated increased cash flow as they passed price increases of energy and inputs onto clients. This drove robust financial performance, enabling companies to service their debt facilities, which had been impacted by rising interest rates, and to distribute dividends.

Graphic: Moore Kingston Smith

However, profits have been impacted as manufacturers prioritise maintaining or growing market share. This has created fierce pricing competition and made it difficult to maintain momentum as margins are squeezed. These factors, in combination with uncertainty around capital gains tax, may incentivise more shareholders to consider selling their business. “Increasing inbound enquiries attest to growing appetite for selling and we expect dealflow to increase over the coming year. The challenge will be normalising profits to arrive at a valuation given the confluence of fluctuating energy, commodity and material costs alongside manufacturers using pricing to retain customers,” Marc Fecher, Corporate Finance Partner, warns.

Just as today’s backdrop impacts tomorrow’s investment activity, deals completing now will have begun around 12 months ago, given the time required to prepare, run a process and agree terms. Businesses being sold now are those doing well, with cash preservation a clear priority for performance as managers carefully manage stock. It means pre-orders are giving way to just-in-time inventory management to address lower cash flows. “Taking action in poorer performing parts of a business can create longer-term value and boost EBITDA and future earnings,” Jeremy Read advises.

Picture: Getty/iStock

Foreign investment into UK manufacturing gaining steam

It is also worth noting that foreign investors are increasingly attracted to British manufacturing businesses and may have different preferences, while corporate investors, private equity and VC are all investing in relatively equal proportions. We encourage vendors to be open to conversations with both strategic and financial acquirers, as this can enable more flexible transaction structures.

“There are a lot more conversations as people explore their options. The biggest concern people have is that performance this year may lag behind last year’s financially as they push for growth and market share, so they need to tell the story around that and balance margins with customers,” says Marc Fecher.

Jeremy Read advises: “Business owners always want to maximise the performance of their business. Good times and bad times have ebbed and flowed and it’s worth thinking about how to maximise value now so you are prepared for a liquidity event in the near- to medium-term.”

Automotive subsector resilient as others decline; consumer remains most popular for investments

While investment activity has been on a downward trend, certain subsectors stood out. Consumer remains the most popular, with food and drink within that perennially popular for investors. Aerospace and defence, construction and engineering, and automotive recorded small gains between Q1 and Q2, with the green energy transition likely catalysing an increase in electric vehicle (EV) manufacture and the ancillary products and goods around them. In fact, a recent report showed a surge in 2023 of global EV sales, citing nearly 14 million electric cars sold, a 35% increase on 2022 .

The investment data paints a different picture to the output data, which shows motor vehicle manufacturing falling in 2024 after being the fastest growing subsector in 2023 at 14.9%. Pharmaceuticals was the next fastest growing in 2023 (8.0%). With both subsectors being a major focus for investors, it appears that output lags behind investment as plans are made for growth.

It is also the case that PE investment brings resource beyond pure capital; firms receiving backing from experienced financial backers typically benefit from support to accelerate growth in such areas as digital enhancement (including AI and cyber), commercial excellence, sustainability frameworks, geographic expansion and M&A.

Picture: Getty/iStock

Preparing for a possible sale

Framing a company’s story over the last three to five years is an important part of preparing for a sale process. However, it is challenging considering the last few years, with the cost-of-living crisis, raw material costs, labour shortages and fluctuating costs impacting businesses. These unusual circumstances make it more challenging to determine the ‘normal’ levels of trading and profit that businesses should be expecting to make moving forward. In turn, this has impacted sales processes, as determining the ‘normal’ level of profitability is a key driver of valuation.

Each business has a series of unique circumstances to consider and craft a narrative around:

• Fluctuating costs – how have fluctuations in the costs of energy, raw materials and labour impacted the business, and how can you use this to drive future financial performance?

• Structure and size – during the pandemic, a lot of business owners assessed and restructured their operations to ensure investment was focused on their most profitable divisions. Operating a lean and disciplined structure is attractive to prospective acquirers.

• Understanding where customers are in their stock cycles – understanding your customers and your own working capital cycle can lead to a more efficient operation which can unlock incremental value in your business.

• Operating and financial efficiency – look at your company’s structure and investment capital to ascertain whether the financing structure is appropriate. Term loans, invoice financing and specialist lenders can bring different merits at various inflection points of a company’s growth journey, and regularly reassessing what works best is advised.

Looking ahead

The resilience of the manufacturing sector as well as the brighter economic expectations and potential for changes to capital gains tax could point to a boost in deal activity.

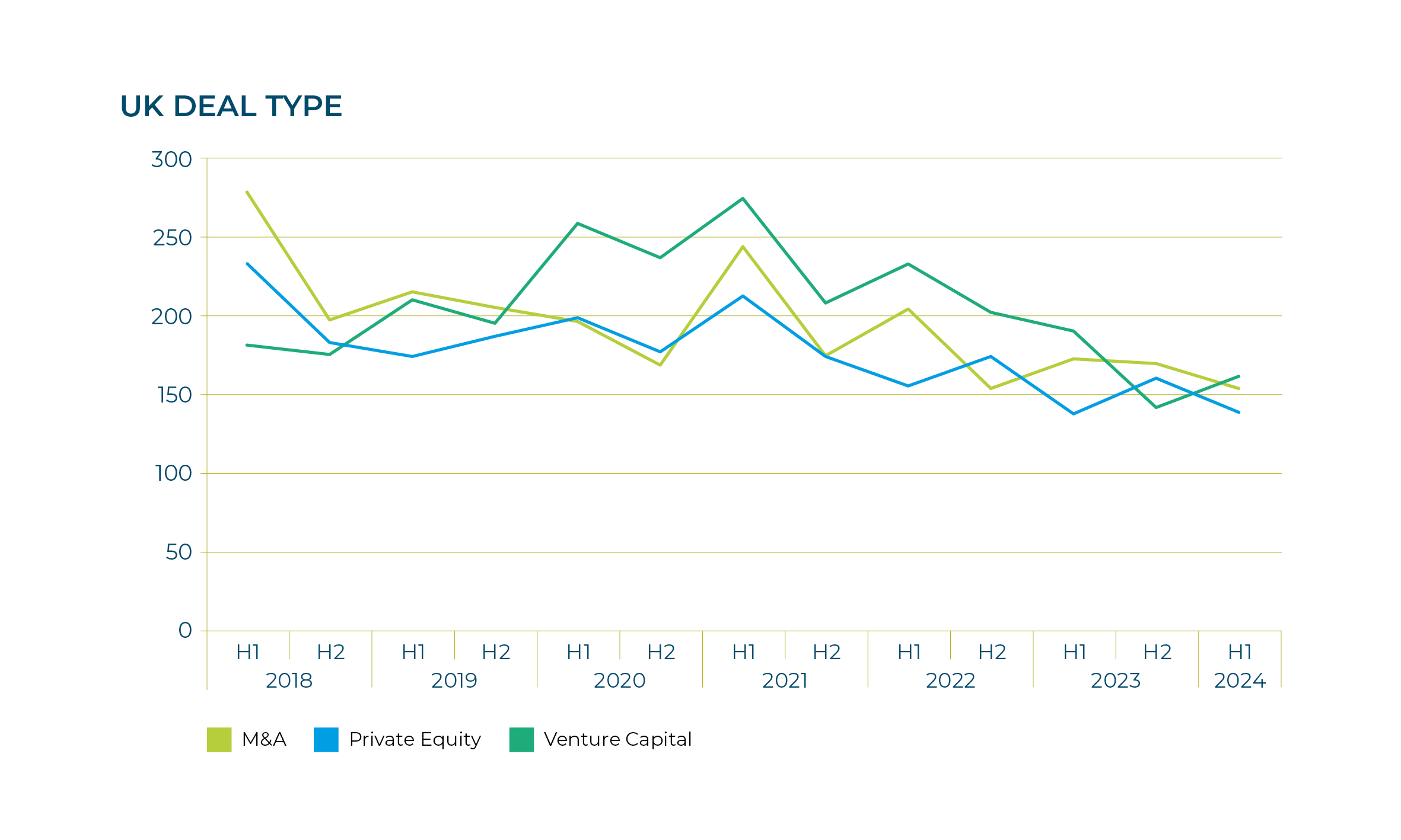

Corporates remain hungry to grow, with M&A providing an efficient way to expand geographically, acquire new verticals and get closer to suppliers and customers. These synergies often support the ‘strategic premium’ paid in processes by corporates, and we continue to see similar hunger from private equity-backed businesses building up platforms.

Graphic: Moore Kingston Smith

Private equity firms are also sitting on significant reserves of committed capital which must be deployed. They are buying up some established businesses as platforms to scale, and/or acquiring smaller ones to consolidate the market. While leverage has been costlier or harder to come by in the last year, there are signs this is shifting, with improved terms for established businesses as well as new ways to create capital structures to facilitate deals.

“Manufacturing companies require capex to invest in production lines and other equipment but the higher cost of capital and uncertainty may have reduced the willingness of companies to invest in recent years. Government support has softened some costs, particularly capex, so it may be that the sector shrinkage belies the fact that UK manufacturing may be at its most efficient and well invested, making it more attractive to investors and buyers,” says Marc Fecher.

Buyer appetite has returned, and a change in government is likely to mean a shift in tax rates and allowances. Preparing your business for a sale is an important step to take to enable you to time the market correctly.