6 minute read • published in partnership with Lloyds

Strength in motion – How Seminar Components is driving global growth through bold investment

By relocating to a larger site, bringing key processes in-house and automating production, Seminar Components has created capacity and reduced reliance on subcontractors. The manufacturer of precision seating mechanisms is now targeting 25% growth in the next 12 months, with the foundations firmly in place to deliver it.

Seminar Components is at the forefront of motion seating design and engineering, combining unrivalled knowledge of mechanism design with a relentless focus on engineering excellence and performance. From its 50,000 sq ft facility in South Wales, the business produces over 150 variations of lift and recline mechanisms for the healthcare and retail sectors and is a specialist manufacturer in this niche.

For more than 30 years, Seminar has built its reputation on precision, continuous innovation and close collaboration with suppliers and customers. Yet as demand for its products rose, capacity constraints threatened to stall the next phase of growth.

Faced with an opportunity to accelerate international expansion, the leadership team chose to invest in new facilities to centralise functions and futureproof production. The move, coupled with automation and new in-house capability, has given Seminar the platform to scale with confidence.

A site built for growth

For much of its history, Seminar operated across multiple rental units, a setup that made process improvements almost impossible and limited expansion. Welding and painting departments were running three shifts to keep up with orders, and there was no space for additional cells or a larger paint plant. A growing collection of overflow storage containers cluttering the yard clearly signalled the need for change.

A four-acre former Remploy site, located less than a mile away, provided the solution. Having purchased the site, Seminar invested significantly in renovations and upgrades, supported by retained profits and funding from Lloyds. Over 18 months, roofs were stripped, lean-tos were removed, a rear extension was added and buildings were reconfigured – all to maximise efficiency and create space for long-term growth.

Lloyds has been a strategic partner throughout, providing tailored funding packages and support that have been integral to Seminar’s success. “The bank took the time to truly understand our operations and ambitions,” says Philip Lempriere, Finance Director. “They’ve been more than just a lender to us. Everyone we’ve come into contact with has honestly been fantastic.”

Jonathan Michael, Associate Director for Trade and Working Capital at Lloyds, added: “It’s been fantastic working with the team at Seminar and being able to support their growth plans. The strong long-term vision, great people-focused culture, and emphasis on product R&D reflect an outstanding commitment to continuous improvement and innovation.”

Investing in future capacity and capability

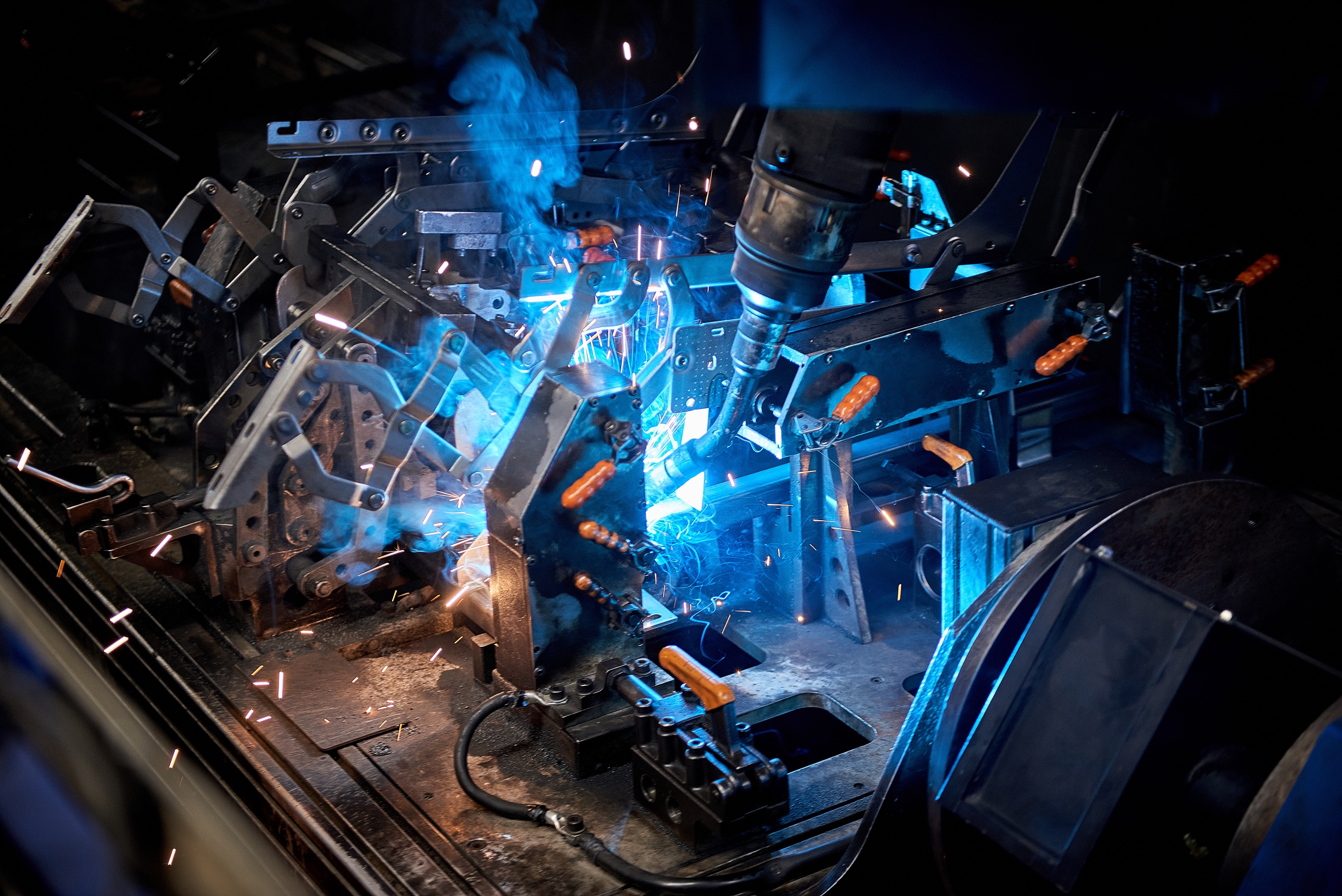

With a centralised site in place, attention has turned to removing bottlenecks and increasing output through targeted equipment investments. Automation is a clear priority. Seminar already had four robotic welding machines prior to relocating, the first pair purchased in 2017 with an Asset Finance facility from Lloyds. That number has since grown to seven, delivering faster cycle times, consistently high-quality welds, and a safer, more controlled working environment.

The finishing end of production has undergone a far larger upgrade. The ageing paint plant has been replaced with a high-capacity semi-automated line, supported by a modern compressed air system. The majority of spraying is now handled by a reciprocator, providing a precise, uniform finish at double the previous speed. The upgrade has removed one of Seminar’s biggest bottlenecks, reduced the need for multiple shifts and freed operators to focus on loading, unloading and final touch up.

With skilled welders and sprayers becoming increasingly hard to find, automation is both expanding capacity for a growing order book and building long-term resilience. Processes are also being brought under Seminar’s direct control to reduce reliance on external suppliers and improve lead times.

Two industrial bandsaws and a 400-ton Power Press have recently been added to the operation. The press performs multiple operations in a single strike, meaning components that required blanking, forming and piercing on separate machines can now be produced in a single setup.

Financed through an export loan facility with Lloyds, the machine is already delivering a strong return. “Components that previously cost considerably more externally are now produced in-house at a fraction of the price,” Philip explains. “The savings generated are funding both the press and the technician hired to run it.”

These investments have propelled weekly output to a record high, with higher consistency driving a stronger first-time pass rate. Even more impressive is that headcount has stayed broadly consistent, and departments now operate on a single shift, leaving significant headroom to scale without adding overheads.

Building scale through strategic acquisition

Innovation is as central to Seminar’s growth strategy as production capacity. The design team, nearly doubled in size in recent years, delivers both incremental improvements and breakthrough developments, including two new mechanisms launching imminently in direct response to customer feedback.

This design-led, made-to-measure capability is a key differentiator. Where imported mechanisms are sold in fixed sizes and large batches, Seminar can tailor widths and supply in small, flexible runs. This agility has seen the business win and retain major contracts despite pressure from low-cost imports.

To further strengthen its market position, Seminar acquired a majority shareholding in Recliners UK (formerly Suite Options Ltd) in late 2024, funded through cash reserves and loan notes. The strategic move marries Seminar’s mechanism expertise with finished furniture production, allowing the business to offer fully assembled chairs with superior UK-made mechanisms – a compelling alternative to imported products.

The acquisition was also defensive. By stepping in, the leadership team avoided the risk of a venture capitalist or competitor acquiring a major customer while creating new growth potential for both companies.

By combining deeper design capabilities with ownership of a critical link in the supply chain, Seminar is intentionally evolving into a vertically integrated business, positioned to grow its specialist offering, respond to market opportunities, and maintain its high standards for quality, delivery and service.

Expanding global reach

For the immediate future, Seminar is focused on expanding its international presence while continuing to strengthen its domestic base. The business recently signed a distribution agreement for Australia and is now exploring the US market for its bariatric range – chairs designed for users over 200kg. This is a space few manufacturers, even in the US, currently serve, presenting a rare opportunity for Seminar to establish a foothold in one of the world’s largest seating markets.

Automation investments will also continue. A planned CNC riveting system, likely funded via Asset Finance from Lloyds, will further heighten product quality through greater accuracy, consistency and process monitoring.

Sustainability efforts are advancing in parallel, with a strategy focused on small actions having a collective impact. LED lighting, improved building insulation, programmable heating, eco-friendly packaging and planned solar panels and EV charging stations are all helping reduce the business’s energy use and environmental footprint year on year.

With bold investments, global ambitions and a deliberate strategy of innovation plus automation, Seminar Components is showing how a niche manufacturer can scale, while setting a benchmark for specialist seating that extends far beyond South Wales.