2 minute read • published in partnership with Moore Kingston Smith

UK manufacturing sector still leads Europe for M&A activity according to new report

According to a new report by Moore Kingston Smith, the UK manufacturing sector held its position as Europe’s leading deal market in 2024, capturing 21% of all transactions. However, the sector experienced a year of fluctuating confidence, influenced by political events, economic pressures, and the rise of artificial intelligence.

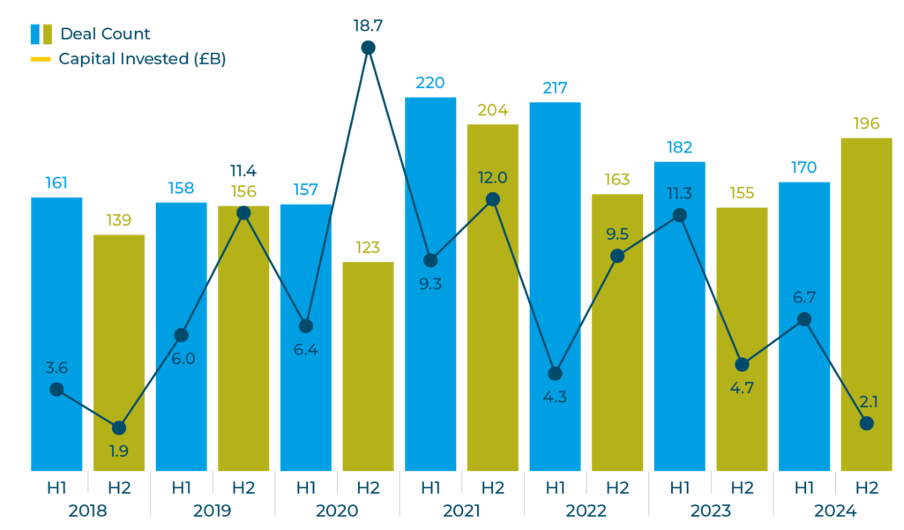

While foreign investment in UK manufacturing continued to climb, overall deal volume saw a 9% decrease compared to 2023, reflecting a broader European trend. The report highlights a “whiplash” effect in the latter half of the year, with initial post-election optimism giving way to concerns following the Budget, which introduced changes to national insurance, capital gains tax, and inheritance tax. These changes, coupled with global economic uncertainties, led to a decline in business confidence and a contraction in manufacturing activity.

Despite these challenges, the report emphasises AI’s potential to boost efficiency and cost savings. While many manufacturers recognise AI’s importance, a knowledge gap exists regarding its practical applications. In response, Moore Kingston Smith is helping manufacturers address this by offering a proprietary platform to help businesses integrate AI effectively.

According to a new mergers and acquisitions report by Moore Kingston Smith, the UK manufacturing sector held its position as Europe’s leading deal market in 2024 / Picture: Getty/iStock

Looking ahead, the report suggests that finding growth and value will be a key challenge in 2025. With lower European growth rates, consolidation and roll-ups are expected to be key strategies. Lower valuations also present opportunities for private equity investment. The report anticipates increased focus on AI in manufacturing, after the Prime Minister’s unveiled plans to position London as the global hub for AI. Also, the transatlantic relationship remains strong, with US investors showing significant interest in UK manufacturing.

Moore Kingston Smith is advising businesses to prepare for the changing landscape by planning ahead to minimise costs and maximise shareholder value. They anticipate increased M&A activity as interest rates stabilise and well-capitalised investors seek opportunities. While inbound inquiries are slightly down year-on-year, they are driven by more concrete reasons for sale, suggesting a higher conversion rate. The firm’s report underscores the need for businesses to adapt to the evolving economic climate and leverage new technologies to remain competitive.