2 minute read • published in partnership with Haines Watts

Insight: Cash injection for manufacturers during uncertain times

The best-run companies regularly assess how their operations would be impacted by unpredictable events, but no one could have foreseen how the outbreak of Covid-19 would impact supply chains across the world. Haines Watts look at how R&D tax relief could help the manufacturing sector during the current crisis.

In this strange new world we find ourselves in (for how long?, who knows) where workshop floors are empty, supply chains are broken and employees are being furloughed and with banks and furlough payments taking longer than probably the government intended it’s critical that cash-starved companies consider every opportunity available to them.

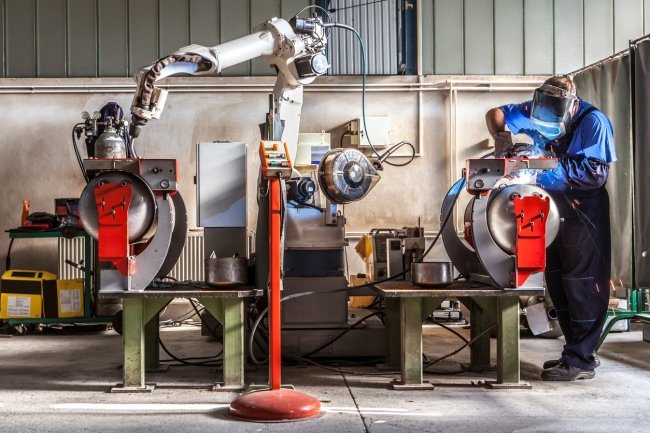

R&D tax relief could play a significant role to support cash-starved manufacturing businesses during the current crisis / Picture: Getty/iStock

Haines Watts R&D North West has successfully prepared research and development tax relief claims for numerous manufacturing and engineering companies over the years, and having recently completed a £243k claim for a manufacturing company (a lifeline given the economic climate since their biggest clients are London bars, high street chains and airports), we’ve detailed below some of the projects our clients have undertaken to help other companies identify where they may have a claim:

• Tooling and equipment design and development

• Prototyping, including designing, constructing and testing products

• 3D modelling

• Evaluating and determining the most efficient material profile for products and processes

• Streamlining manufacturing processes through automation

• Integrating materials to improve product performance

• Developing novel and innovative control programs

• Development of second and third generation products

• Scaling up of production processes

R&D Tax Credits is a Government incentive designed to reward innovation and accelerate growth in UK Companies.

Claims can be made in respect of previous accounting periods (up to 2 years) and you can even benefit if you are loss-making.

R&D takes place in any sector and although it was introduced 20 years ago, there are lots of qualifying companies that have not made a claim yet.

If a company spends time and money on developing new products, services or processes or enhancing existing ones, then it could make a claim for R&D tax relief.

The main areas of costs that can be claimed in respect of the R&D activities are:

• Staff costs

• Subcontractor costs

• Consumed materials

• Agency workers

• Software

• Consumables, i.e. heat, light and power used during the R&D process

Haines Watts advises companies of all shapes and sizes, and handle claims from start to finish. The team work with clients to ensure they are capturing all costs, developing a full R&D strategy, work closely to foster organic growth, with R&D at the core.

To find out more and explore how R&D Tax Credits can support your business, contact Anna Fisher on 07591 204833 or afisher@hwca.com.