2 minute read - 27th July 2022

Steady growth for subcontract manufacturing sector in Q2

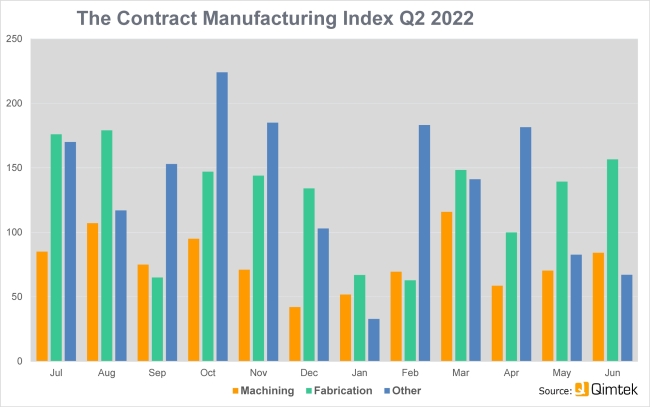

The latest Contract Manufacturing Index shows that despite underlying volatility, the UK subcontract manufacturing market grew steadily through the second quarter of 2022. Following a drop from March to April the market recovered and was up overall for the quarter.

The overall figures disguise the differences in the markets for machining and fabrication services. The machining market was down by 10% – accounting for a third of all business, while fabrication was up by 42% on the previous quarter and accounted for 57% of the market.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3.4bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

Despite ongoing volatility, the UK subcontract manufacturing market overall grew steadily through the second quarter of 2022 / Picture: Getty/iStock

The baseline for the index is 100, which represents the average size of the subcontract manufacturing market between 2014 and 2018. The CMI for the second quarter of 2022 was 101, compared to 89 for the first quarter of the year and compared to 110 in the final quarter of 2021 and 77 in the equivalent quarter last year. The average CMI over the past 12 months is 104.

The strongest sector was industrial machinery. This was also the top sector in Q1 and grew by 10% in Q2. The second biggest sector was food and beverage, which jumped from number 18 in the rankings in Q1. The third strongest sector interestingly was ‘other’, which covers all the activities not included in the major categories. This grew from a very low base to account for 13% of the market in Q2. This could be taken to suggest an underlying strength across manufacturing.

The biggest fallers were furniture, down 57%, and trucks and transport (non-automotive), which spiked strongly in Q1 but fell to only 3% of its peak value in Q2.

Qimtek owner Karl Wigart, said: “The strong top line performance belies what has been a very up and down market. You can see this in the wildly different performance fabrication and machining and in the volatility in specific sectors.

“I think that this is a good reflection of the market with all its current uncertainty. We know suppliers are having tough time with supply chain issues, employment and energy costs. The average number of quotes we are getting has dropped again this quarter by around 4%. We can only hope that the upward trend in business continues.”

Graphic & data courtesy of Qimtek