1 minute read • published in partnership with Visiativ

Insight: Preparing for the R&D tax credits overhaul – what manufacturers need to know

The Government is to overhaul the legislation and guidelines for R&C tax credits. Sandy Findlay from Visiativ looks at what manufacturers need to be aware of while embracing change for long-term innovation and global competitiveness.

August 1st will see some of the biggest changes in the process of claiming R&D tax credits since the scheme began in 2000. By embracing these changes, manufacturing businesses can harness the long-term benefits of innovation and maintain their competitiveness in global markets.

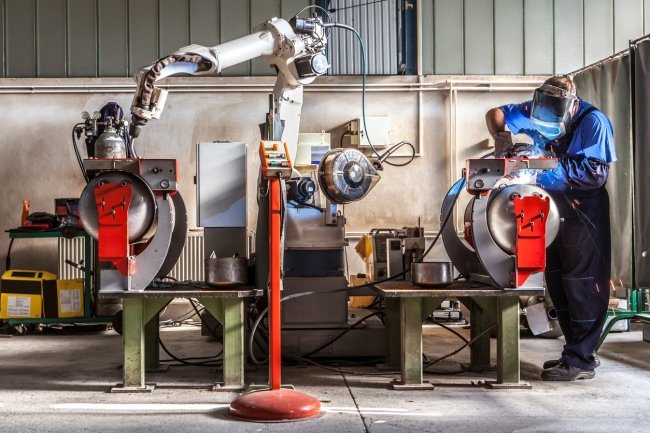

Picture: Getty/iStock

The questions to ask yourself

1 – Are you engaged in high-value R&D activities, such as developing innovative products, processes, or services?

2 – Do you subcontract any of your R&D projects, either within the country or outside the UK?

3 – Do you rely on data throughout your R&D, design and innovation processes?

4 – Are you considering claiming R&D tax relief for the first time?

5 – Do you spend more than 40% of your total expenditure on R&D projects?

6 – Can you provide a clear explanation of the advance in the baseline of knowledge your company is seeking to achieve through your R&D? As well as identify the technical uncertainties which were addressed in the process of making the advance, as well as the work done to resolve these uncertainties?

If you can answer yes to any one of these questions, you need to read this article to find out how these changes might impact you and the things you need to be thinking about to minimise the impact.